The BBIN Initiative Power Corridor: Opportunity to Revive Regional Integration

Mohammad Masudur Rahman

17 September 2020Summary

The outbreak of COVID-19 has changed the global landscape. As a result, the socio-economic dynamics of contemporary South Asia are also changing rapidly. Among others, the lack of access to power will hamper the fight against the COVID-19 pandemic. Without electricity, technologies that connect us while allowing us to maintain social and safe distancing will become obsolete. Regional integration via power trade will bring significant benefits to the region. The Bangladesh, Bhutan, India, Nepal Initiative is already deeply connected through transmission links. It is now time for India, a trading power, to allow its neighbours to use its transmission links for cross-border electricity supply and, in the process, facilitate power to the powerless.

Living in the Dark in the 21st Century

Imagine hospitals without power in this pandemic! Schools from Dhaka to Delhi are closed during this prolonged lockdown. How will patients be treated or pupils study without power and technology? This is a hard reality for about one billion people globally (International Energy Agency, 2020). Nearly nine per cent of rural Indians stay in the dark, while these numbers are double for Bangladesh, Pakistan, and Nepal (World Bank, 2020). Access to electricity is a major concern for all South Asian policymakers. Nevertheless, due to rapid economic growth, India’s power demand projection by 2030 would be between 2,040 Terawatt-hour (TWh) to 2,857 TWh, as forecasted by The Energy and Resource Institute and the Energy Transition Commission India. According to the Bangladesh Power System Master Plan (BPSMP-2016), the country’s electricity need would be 41,890 megawatts (MW) by 2030 and 82,292 MW by 2041. Consistent and reliable clean electricity supply is essential for sustainable economic growth, especially for countries to recover from the current COVID-19 turbulence.

Private Sector in Power Generation: A Bold Initiative

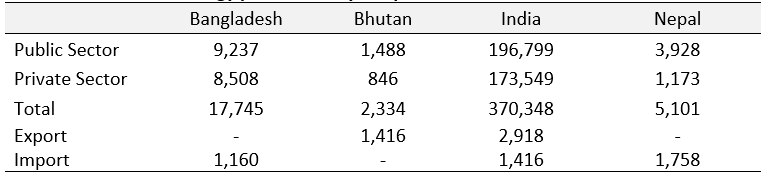

The South Asian power sector has, till recently, been primarily dominated by the public sector, which is highly subsidised and inefficient. However, the private sector has started to play a greater role in accelerating production and efficiency. The Bangladesh, Bhutan, India, Nepal (BBIN) Initiative has made significant progress in power generation over the decades. Bhutan and Nepal have made tremendous progress in their hydropower generation. As shown in to Table 1, India’s private sector generates 46 per cent of its total power production, whereas Bangladesh’s private sector contributes 47 per cent of total power generation. Bhutan’s state-owned enterprises with Indian investment contribute to most of the Himalayan kingdom’s power generation. The Nepalese private industry also produces a large proportion of its power supply. This is an unprecedented change in the South Asian power sector. The engagement with the private sector in the power sector has contributed to not only an increase in production and efficiency, but it has also created a new window of opportunity to accelerate cross-border power trade.

Table 1: South Asian energy production by the private sector in MW in 2019

Source: Compiled from the respective government authorities of Bangladesh, India, Nepal and Bhutan.

BBIN Power Transmission Links: Ready to Go

The BBIN has made significant improvements in developing the interconnection transmission links. Bangladesh and India currently have two transmission links – Bheramara (Bangladesh)-Baharampur (India) and Comilla (Bangladesh)-Tripura (India). Bangladesh is importing electricity from India to address its power supply constraints.

Bhutan-India electricity cooperation started in the 1960s. The former has six interconnection transmission lines in the southwestern border of Tala, Chhukha, Kurichhu, Dagachhu and Punatsangchu towards the Siliguri-Alipurduar corridor in India. The Deothang-Rangia interconnection transmission link in the southeastern border region of Bhutan is also in operation. Another three new transmission links are under construction. Bhutan’s hydropower exports to India have boosted its economy.

Nepal and India have developed vast interconnection transmission links recently. Nepal’s hydropower sector is booming as well. It has 12 interconnections lines connecting with the southern Terai region of Nepal with India. Another six transmission lines are under construction. The Dhalkebar-Muzaffarpur 400kV line project is expected to add 1,000 MW of cross-border transfer capability.

The proposed India-Sri Lanka interconnection link of 387 kilometres, including 127 kilometres of submarine cables between Madurai (India) to Anuradhapura (Sri Lanka) with a capacity of 1,500 MW is under consideration.

BBIN Bilateral Power Trade – Work in Progress

India is the pivotal point of the South Asian power trade. While India has invested in power generation projects in Bhutan, it also imports power from Thimphu. It imported 1,450 MW from Bhutan in 2019 and another 580 MW is in the pipeline. The Bhutanese government has prepared a National Transmission Grid Master Plan to build a hydropower generation capacity of 26,534 MW by 2030. This massive supply of hydropower could immensely increase its revenues from electricity export.

Bangladesh imported about 1,160 MW from India in 2019 and another 500 MW is in the pipeline. India exports and imports power from Nepal. Nepal imported a total of 2,813 GWh of electricity through various transmission links in 2019, according to the Nepal Electricity Authority (NEA), 2020. Recently, it has also started exporting power to India during the off-peak season and has transmitted 34 GWh of electricity to the Indian state of Bihar during the last 2019 fiscal year (NEA, 2020).

Bangladesh and Nepal have been negotiating for cross-border electricity trade and working to develop the interconnection of transmission lines between them across India as per the Guidelines for Import/Export (Cross Border) of Electricity-2018 of India. The Nepalese government has recently given its permission to the Nepal Electricity Authority to trade electricity with Bangladesh (NEA 2020).

Cross-border Trade: Power to the Powerless

The South Asian Association for Regional Cooperation (SAARC) Preferential Trading Arrangement was signed in 1993 while the South Asian Free Trade Area was signed in 2006. However, about two decades later, the cupboard remains bare. South Asia is the least integrated region in the world, and intra-regional trade accounts about five per cent compared to about 50 per cent in East Asia. Recently, Bangladesh has emerged as a regional hub through multi-modal transport as well as a power corridor. Connectivity between Bangladesh and India reached a new high with the development of the inland water route as well as extensive road and railway networks for trans-shipment to the Northeast. Bangladesh has signed trade and transit agreements with Bhutan and Nepal but operational modalities are yet to be finalised. It has offered the use of its seaports and airports to them for their trade. This regional connectivity network can create a sub-regional BBIN power corridor.

Bangladesh is very keen on importing power from Nepal and Bhutan. Similarly, Bhutan and Nepal are also interested in exporting power to not only India, but also to Bangladesh or any other neighbouring country. However, they are unable to trade directly due to the absence of access to cross-border power transmission links. Nepal will export 500 MW to Bangladesh from the Kanali hydropower plant using Indian transmission lines within the next five years. Bangladesh has signed the power purchase and sales agreement with an Indian company to import electricity from Nepal.

India may now allow its neighbours to use their transmission links for cross-border trade, which will provide the opportunity for a sub-regional energy corridor. India has enacted guidelines for cross-border electricity trade but does not allow third counties to use their transmission links for electricity trade. Most South Asian countries are trading electricity bilaterally. However, the absence of a comprehensive cross-border power trade policy creates frustration among the neighbouring countries and impedes the regional integration.

Policy Harmonisation for Deeper Integration

The non-harmonisation of domestic policies among the SAARC countries constitutes a significant barrier for cross-border electricity trade. India recently enacted the Guidelines for Import/Export (Cross Border) of Electricity-2018 to promote cross-border electricity trade with its neighbours. Bangladesh has a Quick Enhancement of Electricity Act 2010, which was amended in 2015, where it permits bilateral trade but does not provide clear guidelines on cross-border trade. The Bhutan Electricity Authority (BEA)-2010 has also allowed for bilateral trade under the BEA Act. Nepal has signed a bilateral agreement with India for its electricity trade.

The SAARC Framework Agreement for Energy Cooperation (Electricity) 2014 was an excellent step for cross-border power trade, but no further progress has been made on the front. Rightly, the SAARC Energy Centre should prepare a cross-border power trade and investment agreement for the SARRC countries to facilitate cross-border energy trade. However, with the current dormant state of the SAARC, that is more of a pipe dream at this point in time.

Cost of Non-cooperation in Power Trade

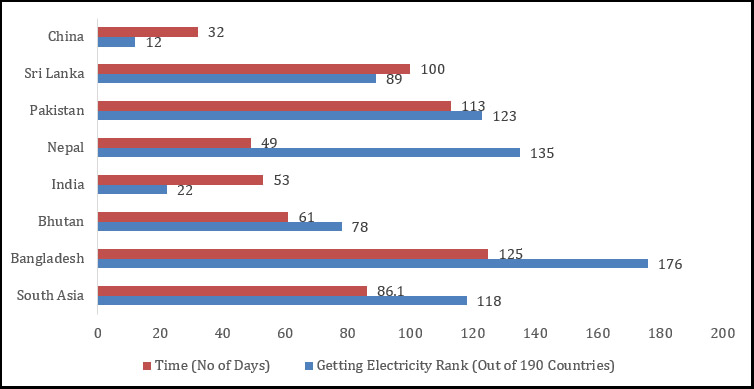

Why are intra-regional trade and investment so low in South Asia? As highlighted in Chart 1, the South Asian countries rank poorly in the ‘Getting Electricity’ criterion. Bangladesh is ranked 168 out of 190 countries in ease of doing business, and 176 out of 190 countries on the ‘Getting Electricity’ criterion. Only India, which ranks 22, fares fairly well. However, it is still way behind China which is ranked 12. The number of days to get an electricity connection in Bangladesh is about 125, while it takes 53 days to get one in India. On the other hand, China provides it within 32 days. This highlights the poor performance and vulnerability of the power sector in the South Asian region.

This index gives a clear negative message to investors who become reluctant to invest in the area in the region. In spite of the fact that the South Asian region has the lowest labour cost, it is unable to integrate into the global supply chain and is not an attractive investment destination.

Recently, Japan declared a new foreign direct investment (FDI) strategy to provide resilience to its supply chain. Called the ‘China exit’ subsidy programme, Tokyo provides support to Japanese firms to move their operations from China to other Asian countries to reduce dependency on China. The South Asian countries must also take advantage of this opportunity and attract FDI to their shores. However, reliable energy supply is a prerequisite to attract FDI.

Chart 1: Getting electricity in South Asia

Source: Ease of doing business, World Bank (2020)

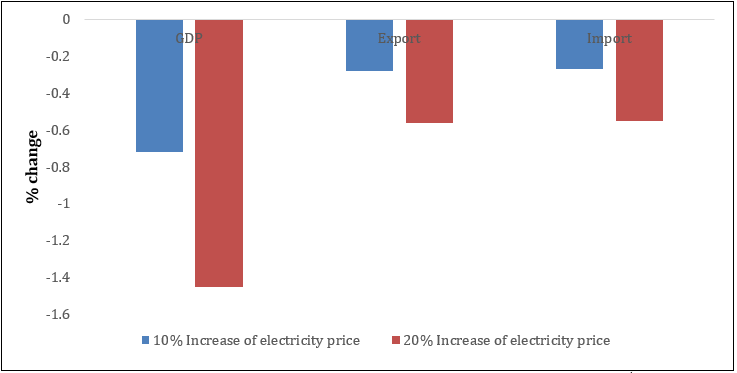

Most of the South Asian countries provide a huge subsidy on electricity. According to the World Bank (2017), removing electricity subsidy and recycling the associated budgetary savings would increase Bangladesh’s gross domestic product (GDP) by about two per cent depending on how the saved budget from subsidy elimination is recycled within the economy. The Bangladesh government, in cooperation with the Japan International Cooperation Agency, has prepared the BPSMP-2016. It analysed the impact of increasing electricity tariffs on the country’s economy. The findings show that increasing electricity tariffs has a substantial adverse effect on real GDP, exports, and imports (Chart 2). The report indicates that a 20-per cent increase in electricity tariff produces a negative impact of 1.45 per cent on real GDP.

Chart 2: Impact of electricity tariff increase on Bangladesh economy

Source: Power System Master Plan-2016, Government of the Peoples’ Republic of Bangladesh

The regional transmission networks could light up the region, and the economic benefits of electricity trade are enormous. To facilitate the cross-border power trade, a National Energy Focal Point (NEFP) under the SAARC Energy Centre would be essential – it would be the local coordinator of the respective countries. A regular technical working group and the ministerial meeting should also rightly be set up through the national focal point. Significant financing is required for power generation and transmission. An investment of US$193 billion (S$264 billion) is needed for Bangladesh for electricity generation, transmission, and distribution by 2041, according to BPSMP-2016. In the normal functioning of the SAARC, the SAARC Energy Centre, in cooperation with the NEFP, could have prepared long-term sustainable financing mechanisms for clean energy investment in the region. However, it is perhaps now opportune for the BBIN to take the lead and to revive some degree of regional integration through the power corridor initiative.

. . . . .

Dr Mohammad Masudur Rahman is a Consultant with the Institute of South Asian Studies (ISAS), an autonomous research institute at the National University of Singapore (NUS). He can be contacted at masudbfti@gmail.com. The author bears full responsibility for the facts cited and opinions expressed in this paper.

Photo credit: green world investor

-

More From :

More From :

-

Tags :

Tags :

-

Download PDF

Download PDF