India-Philippines Trade and Investment Relations: Prospects for the Future

Francis Mark A Quimba, Neil Irwin S Moreno

25 April 2022Summary

India remains a key partner of the Association of Southeast Asians Nations (ASEAN) despite its exclusion from the Regional Comprehensive Economic Partnership agreement. While the Philippines seems to be a minor player in the ASEAN-India relations, its trade – both in goods and services and investment – engagements with India have gained traction over the last decade. Several Indian firms have conducted notable projects across various Philippine industries, such as pharmaceuticals, infrastructure and information technology. The ASEAN-India Free Trade Area, and policies and agreements, have been perceived to be instrumental in stimulating the flow of goods, services and investments between Philippines and India. As evidenced by the signed memoranda and joint statements, recent collaborations signify that both countries are committed to taking advantage of the established momentum and deepening ties. These efforts present significant opportunities for further cooperation.

Introduction

The Philippines and India have had more than 70 years of diplomatic relations. Their ties date back to 1949. The Philippines have signed several memoranda of understanding (MoUs) and agreements with India over the decades to deepen cooperation between the two countries. Examples include the Agreement on Air Services (1949), Cultural Agreement (1969) and Agreement on the Peaceful Use of Nuclear Energy (1969).

Recent Philippine administrations have continued to engage India through memoranda and joint statements. In 2018, Philippines President Rodrigo Duterte paid a visit to India for the ASEAN-India Commemorative Summit and Republic Day celebrations. It was then that the Philippines’ Board of Investments (BOI) and Invest India inked an MoU aimed at facilitating direct investment through cooperation between the BOI and Invest India. The visit also witnessed the extension to the MoU between the India-led National Association of Software and Service Companies and the IT and Business Processing Association of the Philippines. This MoU aims to facilitate direct investments by providing practical investment information to enterprises, assistance to visiting investors and support in the promotion of investment between the two parties.

Given these developments, it would be important to update studies on the relations between the Philippines and India. This paper presents the current state of Philippines-India trade and investment relations and explores areas for further cooperation between the two countries.

Philippines-India Trade and Investment Structure

Trade in Goods

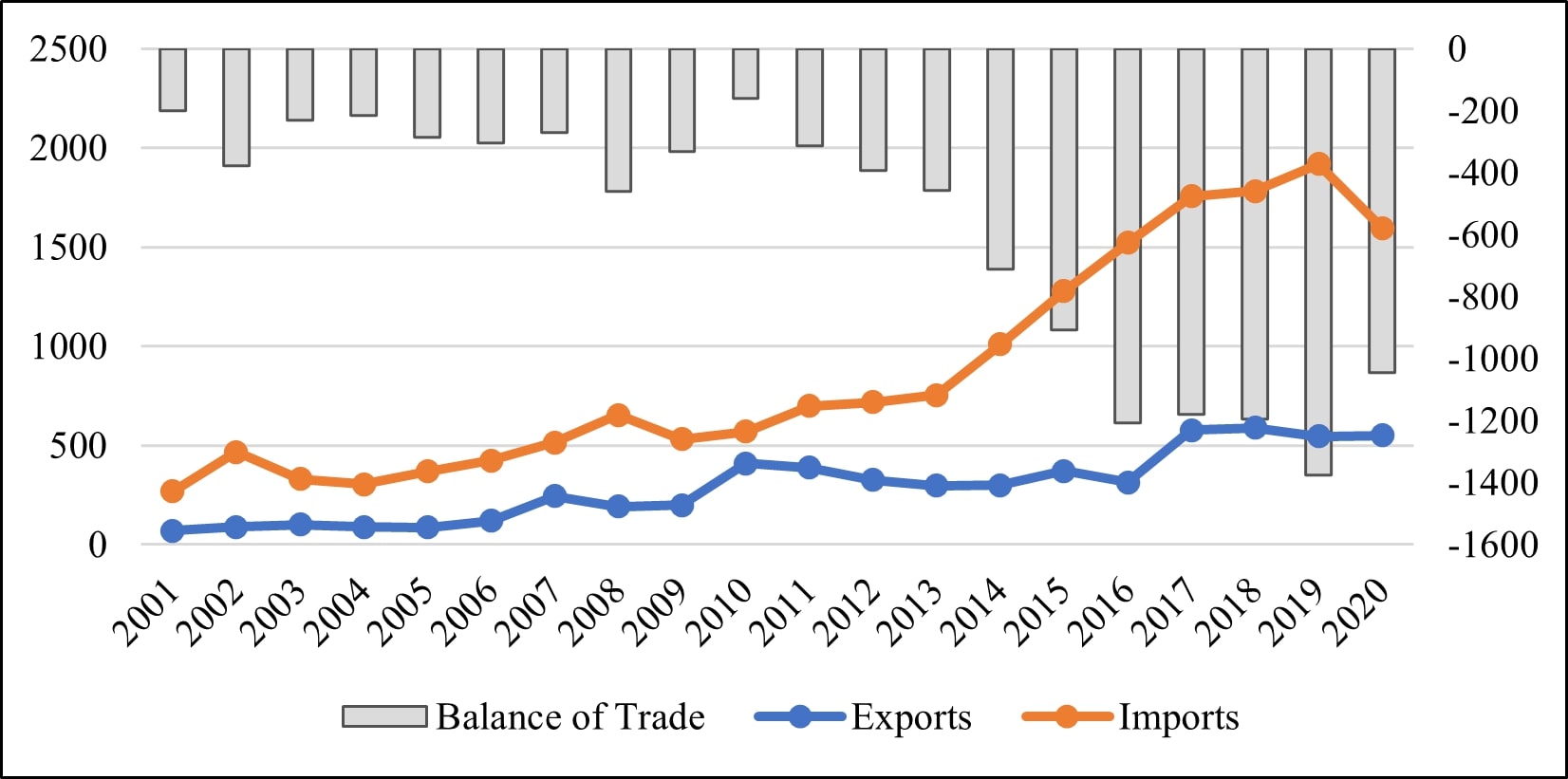

The Philippines has been a net importer in goods trade with India. As shown in Figure 1, the country has been having a negative balance of trade with India since the 2000s. The trade deficit increased considerably during the 2010s, driven by the rapid growth of imports. In particular, imports outpaced exports in terms of growth, resulting in the widening of the country’s trade deficit with India during the decade.

Figure 1: Philippine goods trade with India (in million US$), 2001-2020

Source: World Integrated Trade Solution (WITS), World Bank.

India is a major trading partner of the Philippines. During the 2000s, India only accounted for around 0.2 per cent to 0.5 per cent of Philippines’ total goods exports and 0.7 per cent to 1.2 per cent of Philippine’s imports. On a positive note, the country’s significance in the Philippines’ goods trade increased in the following decade, as its exports and imports shares ranged from 0.5 per cent to 0.9 per cent and 1.1 per cent to 1.8 per cent, respectively.

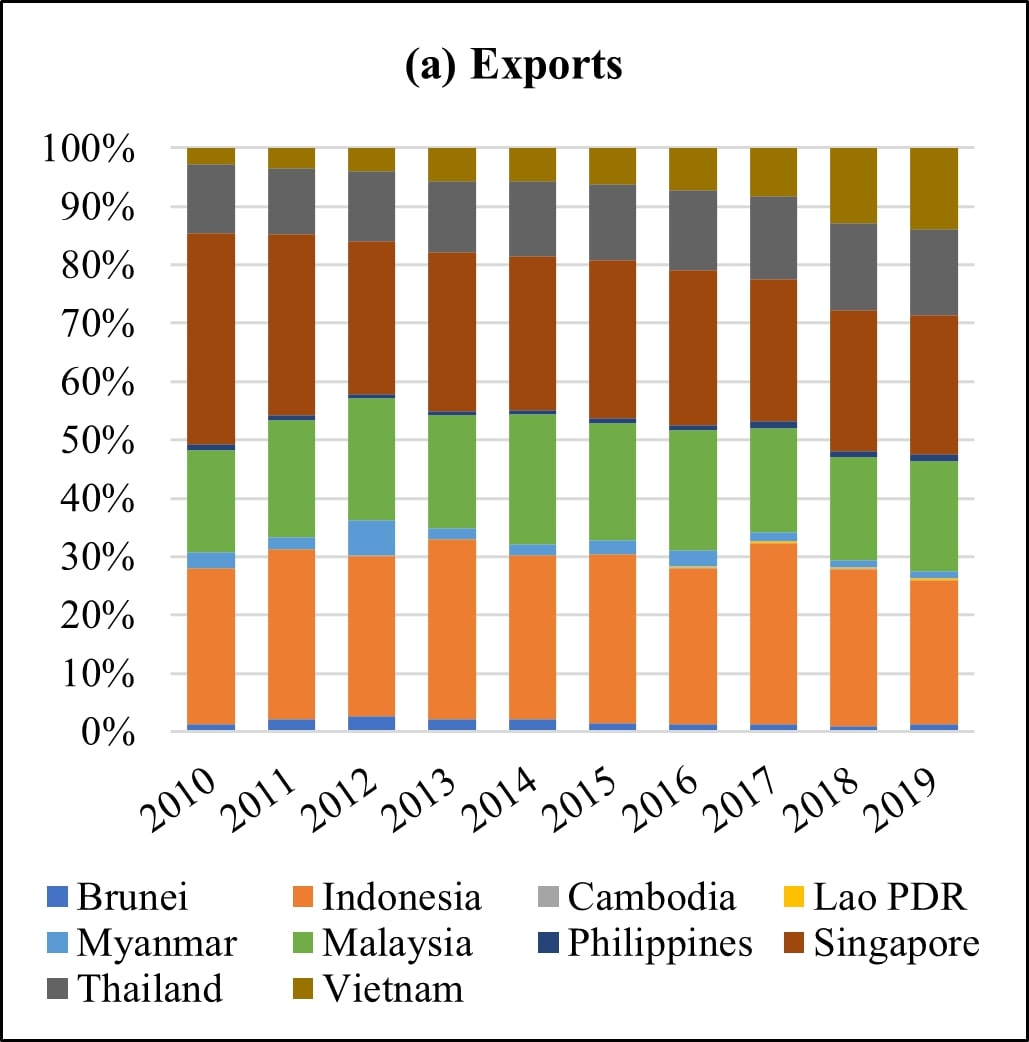

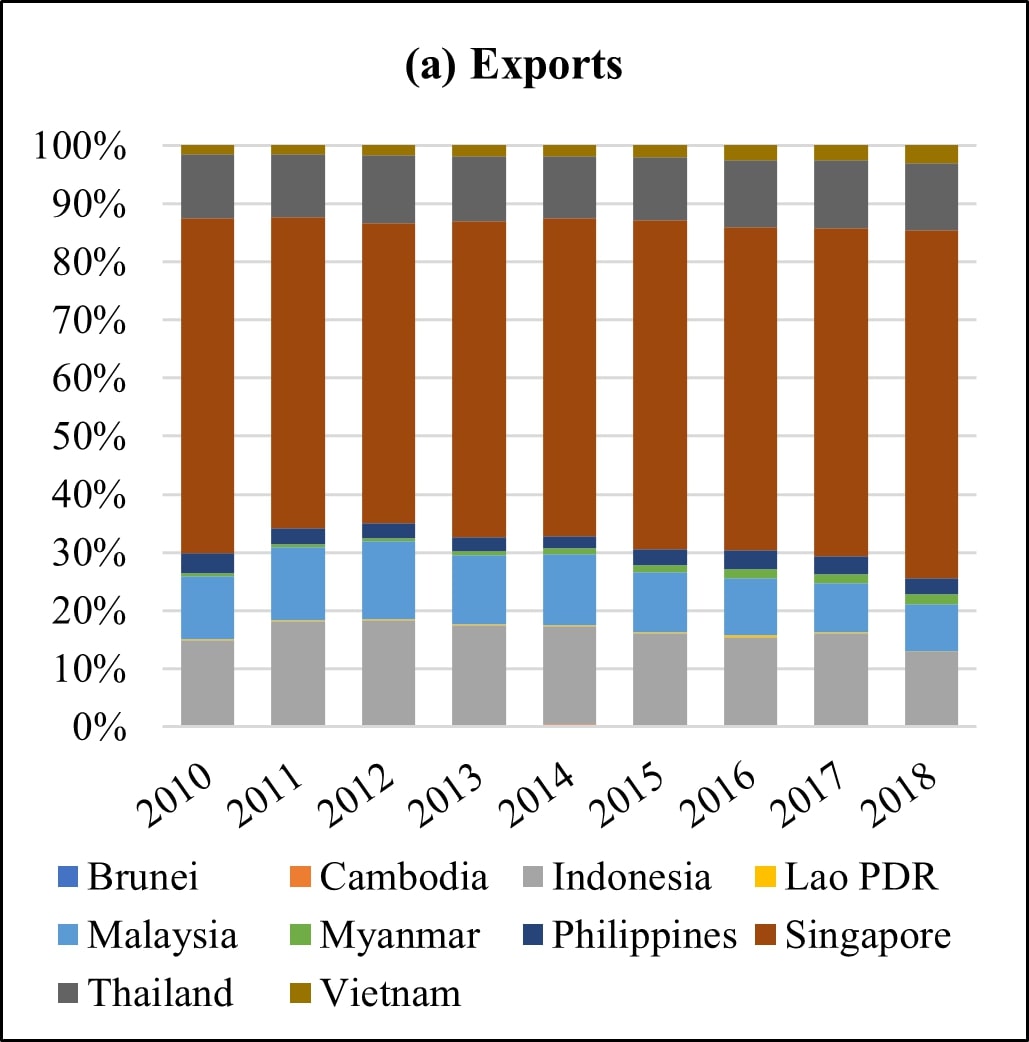

In the context of the ASEAN-India trade, the Philippines has accounted for a small percentage in goods trade. During the 2010s, Singapore and Indonesia were the leading ASEAN exporters to India, posting a combined share of around 50 to 60 per cent of total ASEAN exports to India. Meanwhile, the share of Philippine exports fluctuated during the decade, ranging only between 0.7 per cent and 1.3 per cent. Singapore was also the primary importer of Indian goods. From 2010 to 2012, its share of total ASEAN imports from India ranged from 46 to 50 per cent; however, this gradually decreased in the succeeding years, down to 22.5 per cent in 2019. On the other hand, Thailand and Vietnam slowly emerged as important markets for India in the region. From 20.3 per cent in 2010, their combined shares increased to 31.3 per cent in 2019. Compared to exports, the Philippines accounted for larger shares in ASEAN goods imports from India. Moreover, an increasing trend can be observed during the decade, as the Philippines’ share grew from 2.9 per cent in 2010 to 6.8 per cent in 2019.

Figure 2: ASEAN-India trade in goods, percentage distribution

Note: The figure reports the percentage shares of Philippine-India goods exports and imports in ASEAN-India goods exports and imports, respectively.

Source: WITS, World Bank.

The Philippines has primarily exported machinery, electrical and electronic equipment to India. During the 2000s, the product group covered around 35 per cent of the total exports in India. Its average share further increased in the succeeding decade, from around 41 per cent to 45 per cent. Meanwhile, significant shifts in the import structure were observed during the previous two decades. In the early 2000s, cereals and meat products were the main imports from India, having average annual shares of 20.8 per cent and 17.3 per cent respectively. The share of cereals significantly decreased in the succeeding years, dropping to 2.4 per cent in the late 2010s. Meat products, on the other hand, continued to be a major import from India during the 2010s, although its share declined to 6.1 per cent from the 2016to 2020 period.

Meanwhile, three product groups emerged to be major imports from India: mineral fuels, oils and distillation products; pharmaceutical products; and vehicles other than railway and tramway rolling stocks. From 6.6 per cent in the early 2000s, the average combined share of the said product groups grew substantially to 42.7 per cent in the late 2010s.

Trade in Services

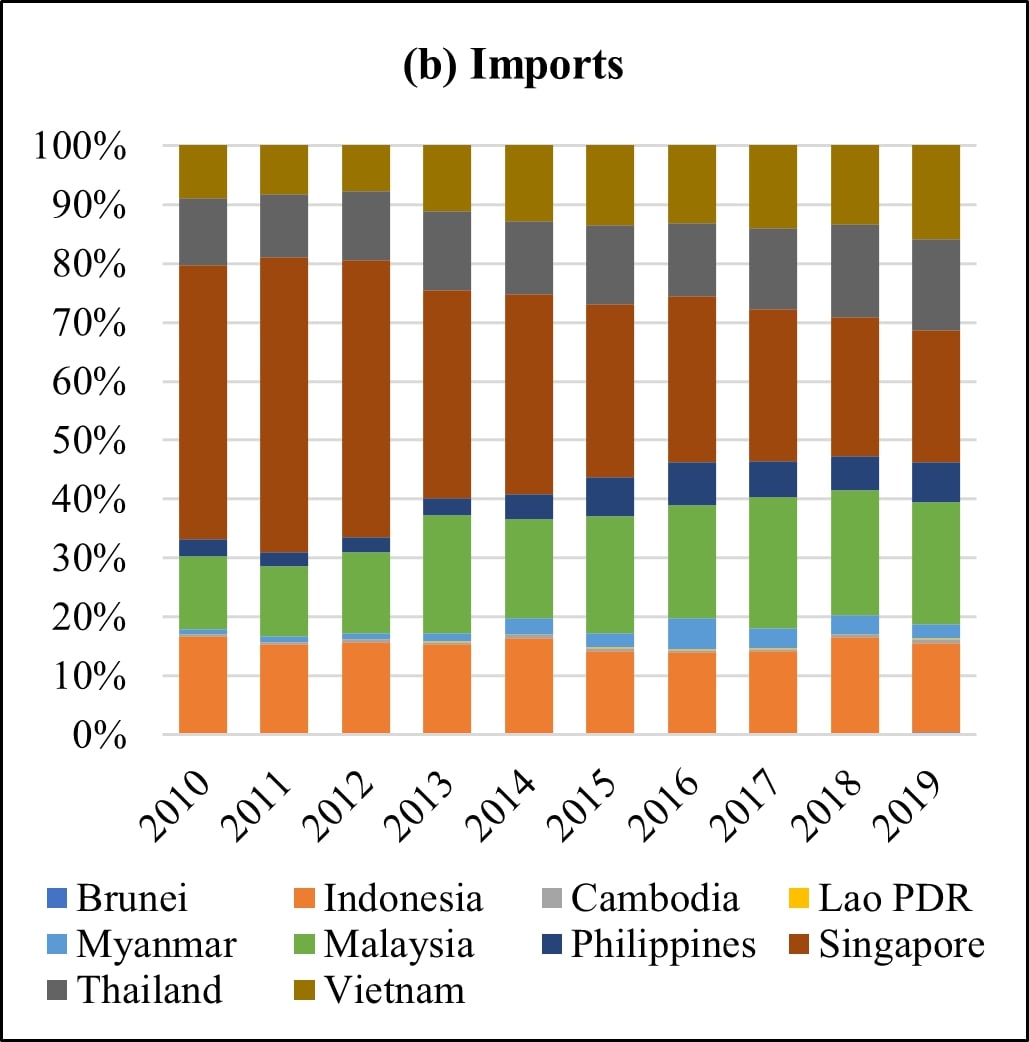

Similar to the goods trade, the Philippines has been a net importer with regard to its services trade with India. The trade deficit also noticeably expanded during the 2010s. This could be attributed to reductions in services exports during the decade’s early years. Despite exhibiting a recovery since 2014, services exports could not match the stable and rapid growth of services imports from India.

Figure 3: Philippine services trade with India (in million US$), 2001-2018

Source: Trade in Value Added (TiVA) database, Organisation for Economic Co-operation and Development (OECD).

India accounted for a higher share in the Philippines’ services trade than goods trade. During the 2000s, the percentage share of exports gradually increased, peaking at two per cent in 2010. However, its share fell in the next five years to 1.1 per cent in 2014; it was able to rebound in the succeeding years, reaching 1.6 per cent in 2018. Services imports exhibited a more stable growth trend from one per cent in 2001 to 3.7 per cent in 2018.

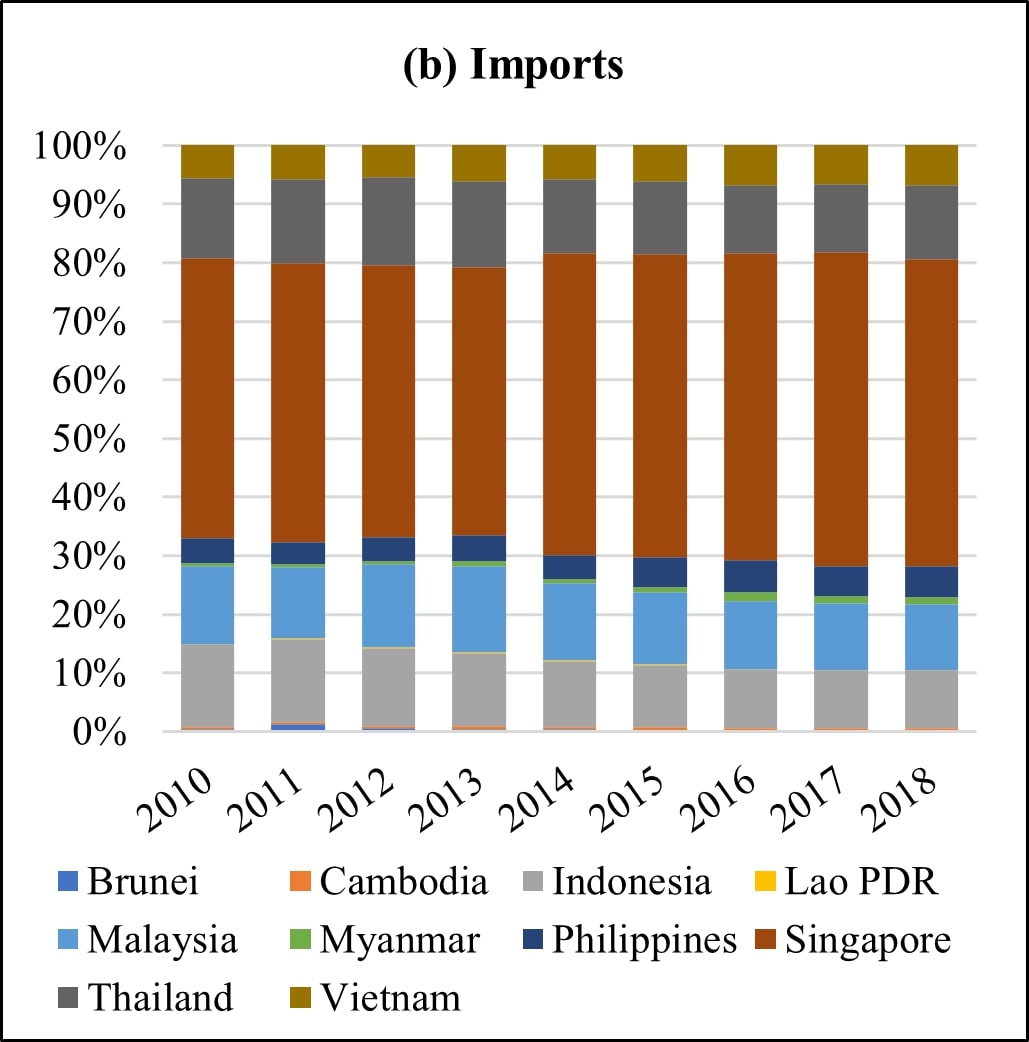

The Philippines has also been a minor player in the ASEAN-India services trade. During the 2010s, its percentage share in ASEAN’s services exports to India stood around 2.2 per cent to 3.5 per cent, while its share in imports ranged from 3.7 per cent and 5.5 per cent. In ASEAN, Singapore was India’s biggest trading partner in services, accounting for around half of the total ASEAN’s services trade with India. Indonesia, Malaysia and Thailand were equally significant trading partners in the region, with their combined shares in ASEAN’s services trade with India ranging between 30 per cent and 40 per cent in the 2010s.

Figure 4: ASEAN-India trade in services, percentage distribution

Source: TiVA database, OECD.

The Philippines has primarily exported services in administrative and support activities to India. Since the 2000s, the sector registered the highest shares in the Philippines’ services exports to India – around 20 to 42 per cent. Wholesale and retail trade services were also an integral component of services exported to India, albeit incurring a decline in shares; from 18.8 per cent in 2001-2005, its average share dwindled to 10.7 per cent in the 2016-2018 period. Meanwhile, computer programming, consultancy and information services gradually became an important sector in exports; its average share since the late 2000s ranged from 15 to 18 per cent, remarkably higher than the 7.1 per cent share in the early 2000s.

Services in computer programming, consultancy and information activities were the primary services imported from India. In the last two decades, it covered around one-third of the Philippines’ services imports from India. Wholesale and retail trade, accommodation and food services, and administrative and support services were also major imported services from India.

Investments

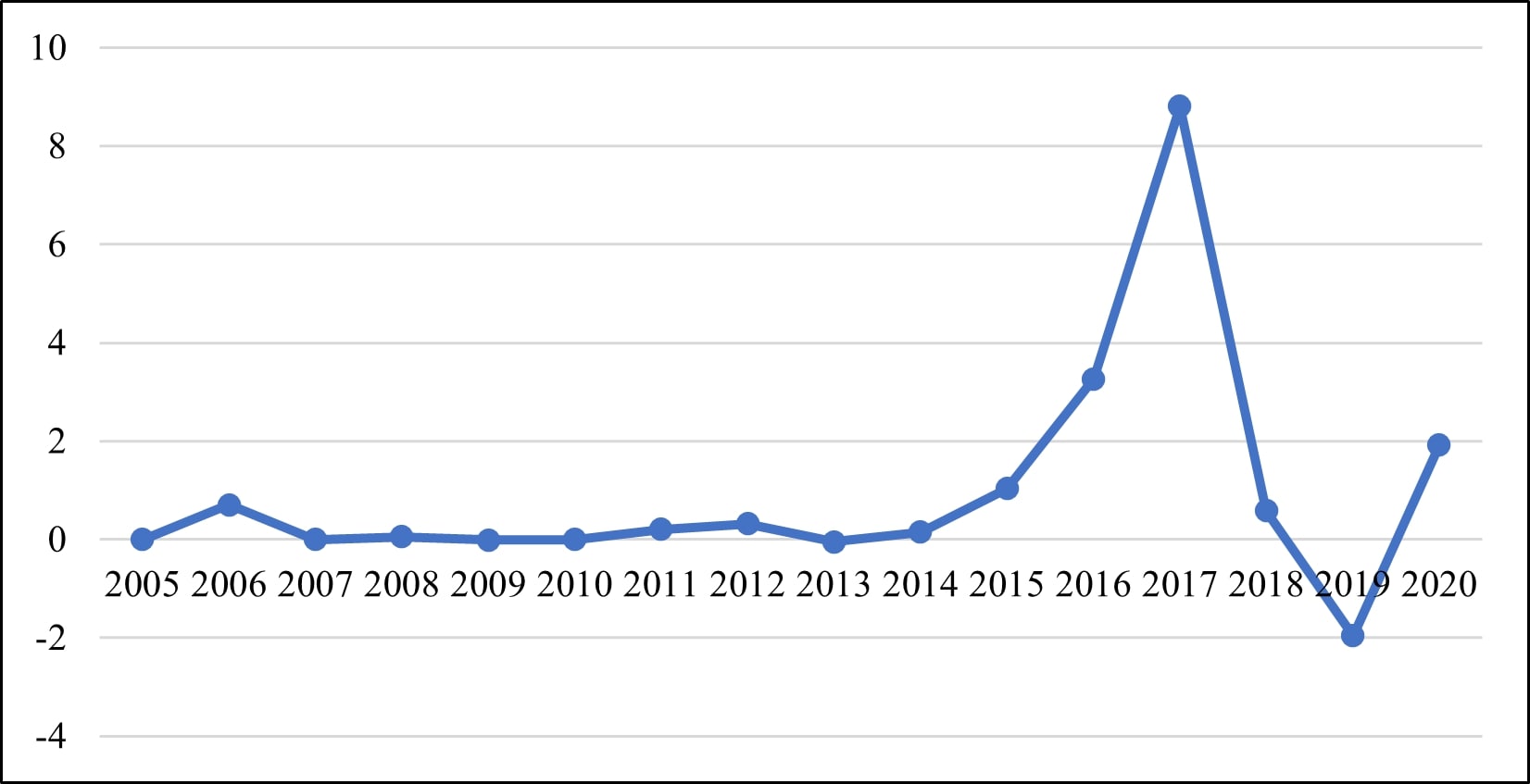

The Philippines’ investment relations with India have been modest in the previous two decades. During the late 2000s, net inflows of foreign direct investments (FDI) from India were negative in 2009 and zero for three other years. The FDI figures improved in the succeeding decade; annual net inflows greater than US$1 million (S$ 1.36 million) were observed in four years—the highest being US$8.8 million (S$ 12 million) in 2017. Meanwhile, negative net inflows have been reported for two years. Reports on Indian FDI outflows reveal that the majority of Indian investment in the Philippines was in financial and insurance activities. Except for 2014 and 2015, the sector has accounted for 70-98 per cent of Indian FDI outflows to the Philippines since 2008.

Figure 5: Philippine FDI inflows from India, (in million US$), 2005-2020

Source: Bangko Sentral ng Pilipinas.

Figure 6: FDI outflows of India to the Philippines, by sector (in million US$)

Source: International Trade Centre (ITC).

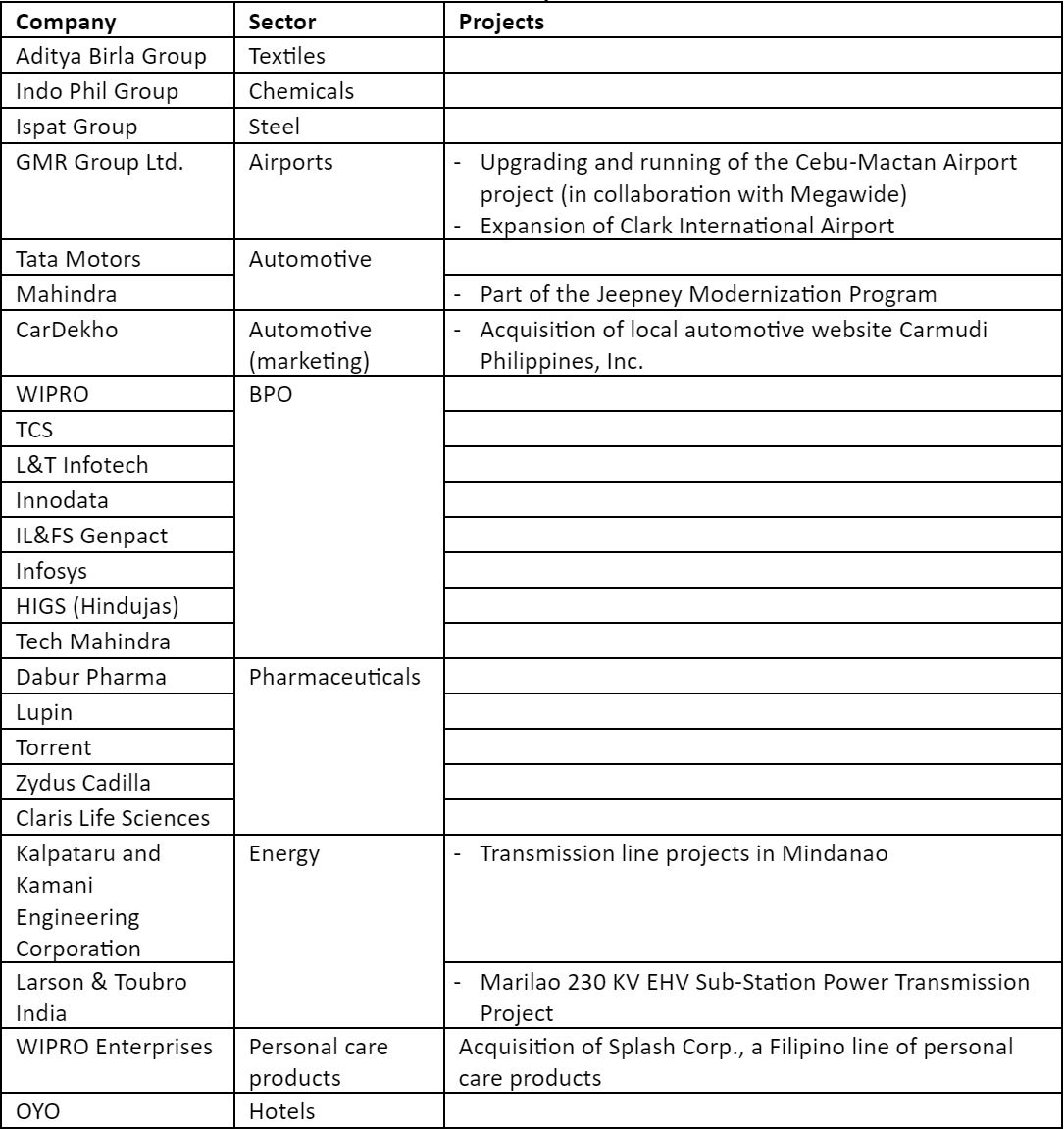

Other notable recipients of Indian investments include textiles, garments, information technology (IT), steel, airports, chemicals, automobiles, pharmaceuticals and business process outsourcing (BPO). Table 1 shows a list of Indian companies that have made significant investments in the Philippines in recent years.

Table 1: Indian investments in the Philippines

Source: Embassy of India, Manila.

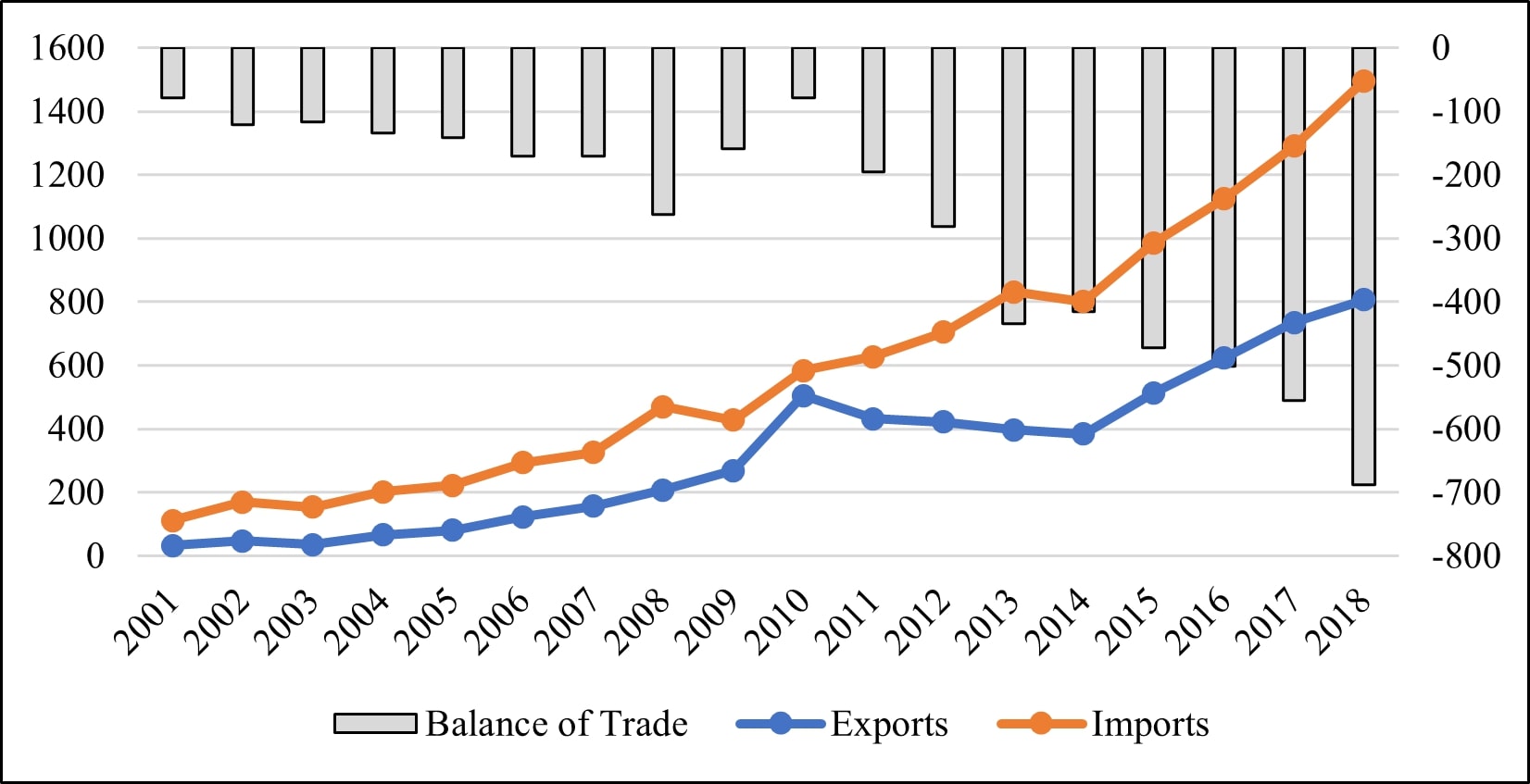

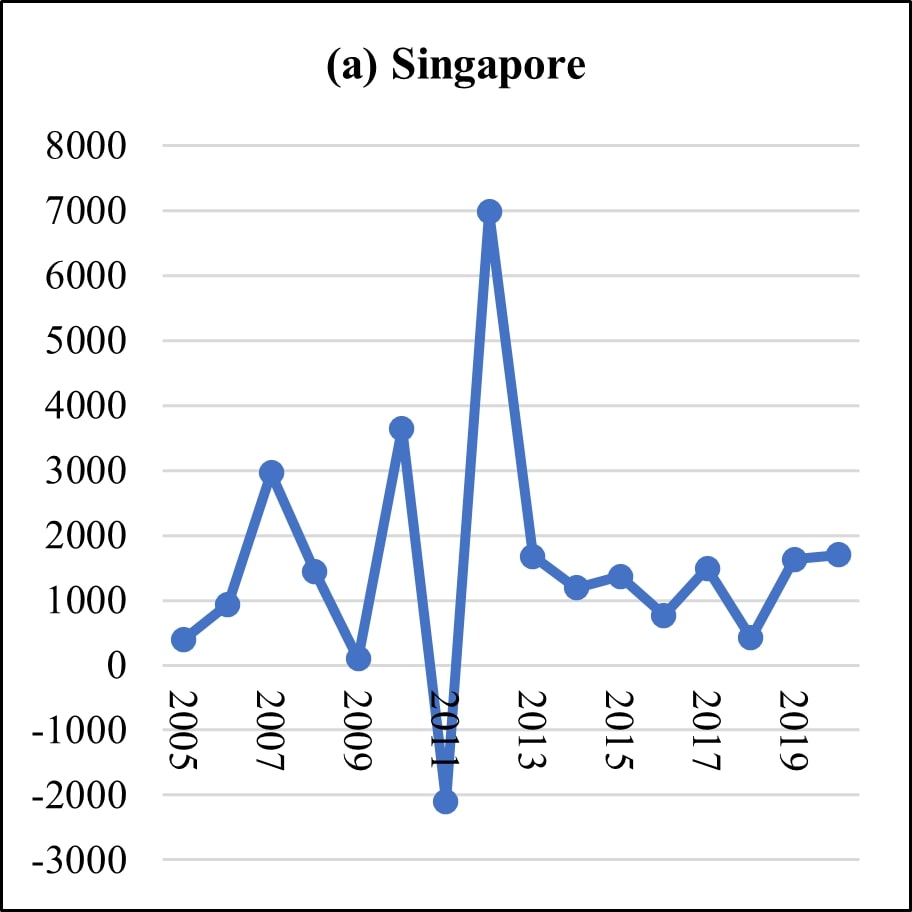

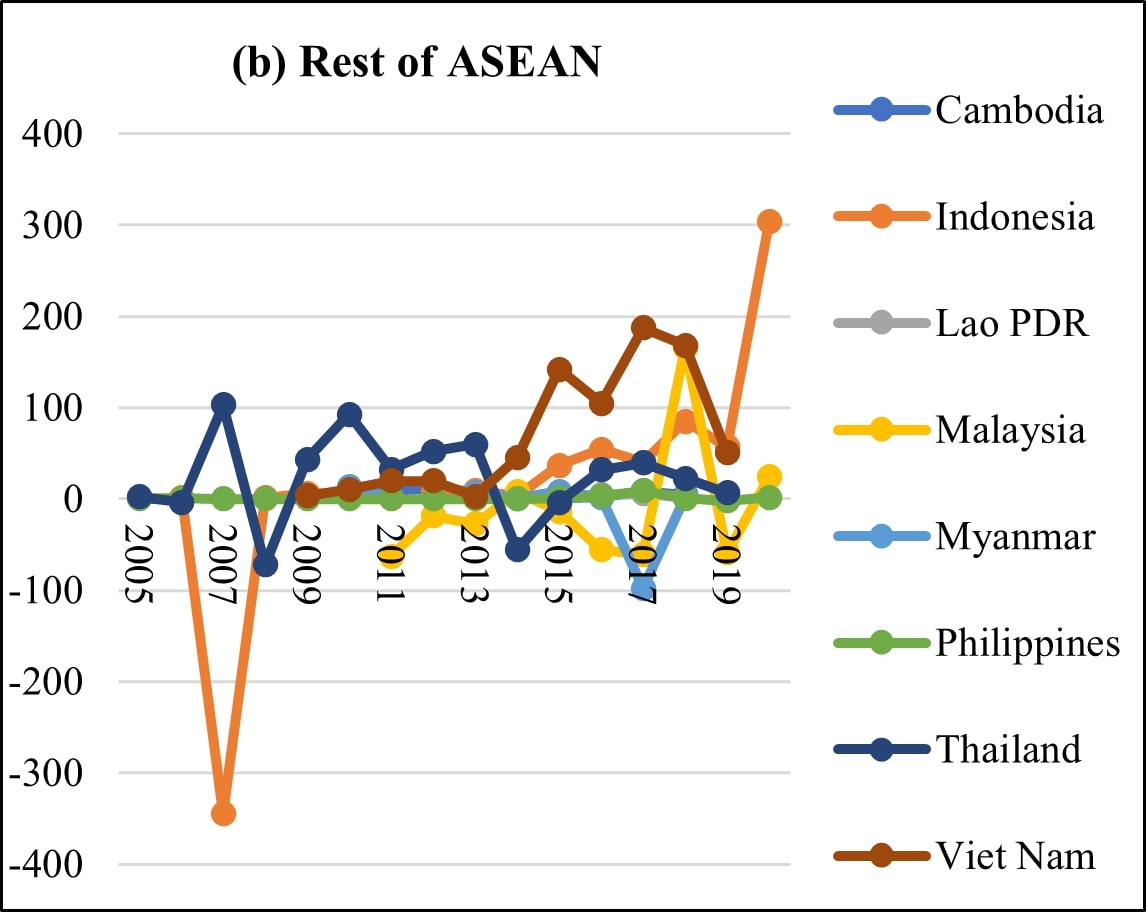

Relative to the other ASEAN countries, India’s FDI inflows to the Philippines have been moderate. Based on Figure 7, Singapore has been the main recipient of Indian investments for several years, since the late 2000s, acquiring net FDI inflows above US$1 billion (S$1.36 billion) . This is much higher than the inflows received by the other ASEAN countries. During the last few years, Indonesia and Vietnam have emerged as new recipients of Indian FDI; in 2020, Indonesia was reported the highest annual inflows from India at US$303.5 million (S$414 million). On the other hand, Philippine FDI inflows seemed to be stagnant between 2005 and 2020.

Figure 7: ASEAN FDI inflows from India (in million US$), 2005-2020

Source: ITC.

Philippine Trade Policy with India

In recent years, the Philippine-India trade relations have been anchored in the ASEAN-India Free Trade Area (AIFTA). The said free trade agreement (FTA) covers agreements in trade in goods and services and investment. According to the World Bank Database on Content of Preferential Agreements, the provisions included in AIFTA cover a number of areas:

- Tariff liberalisation on agriculture and industrial goods; elimination of non-tariff measures (NTMs);

- Provision of information; publication on the Internet of new laws and regulations; training;

- Elimination of export taxes;

- Affirmation of rights and obligations under the World Trade Organization (WTO); Agreement on sanitary and phytosanitary (SPS) measures; harmonization of SPS measures;

- Affirmation of rights and obligations under WTO Agreement on technical barriers to trade; provision of information; harmonization of regulations; mutual recognition agreements;

- Provisions concerning requirements for local content and export performance of FDI;

- Liberalisation of trade in services.

The ASEAN-India Trade in Goods Agreement came into effect on 1 January 2010. It was ratified on 10 April 2010 and implemented on 17 May 2011. The goods agreement entails a commitment by ASEAN and India to progressively eliminate duties on 76.4 per cent of goods and liberalise tariffs on over 90 per cent of goods.[1] According to the tariff schedule for the Philippines, 70.2 per cent of total tariff lines were to have zero rates by the end of 2019.[2]

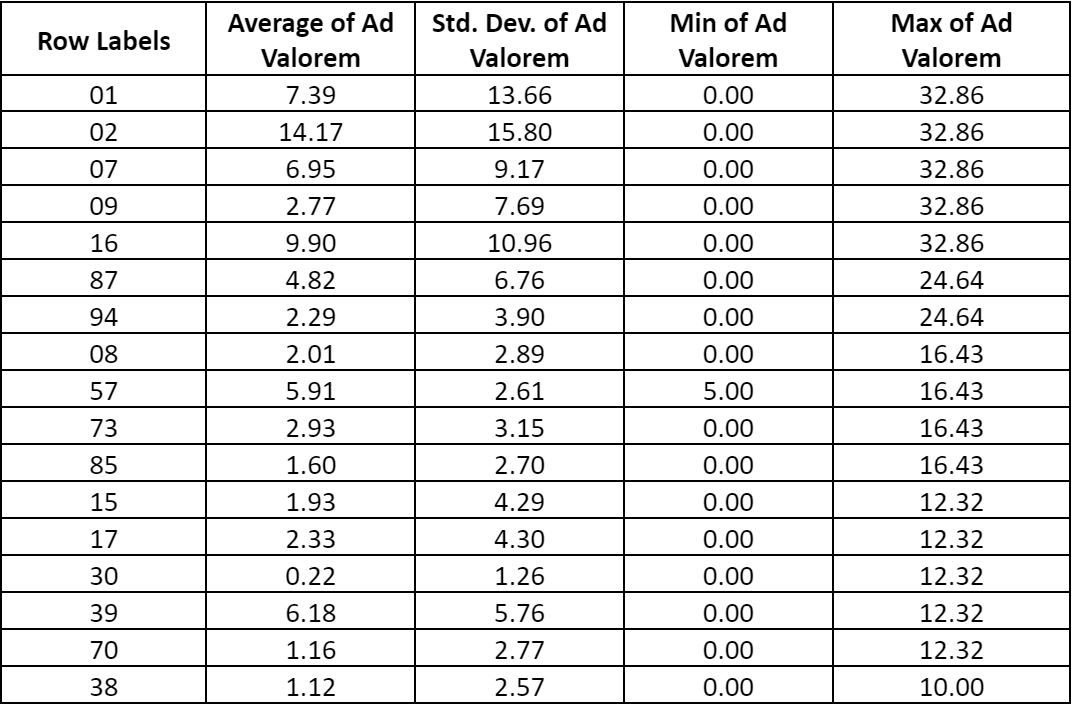

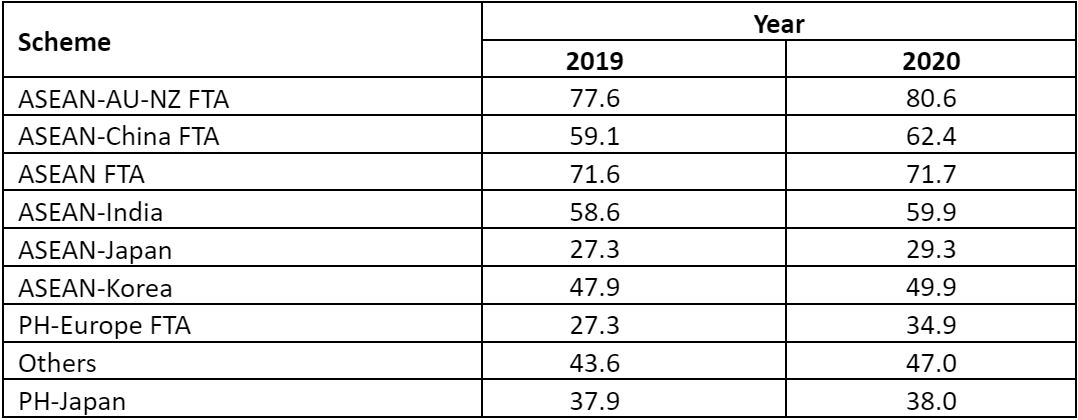

Table 2 shows the tariff structure for the Philippines under ASEAN-India Trade in Goods agreement as of 2019. It shows that while the average tariff rates for most of the goods are relatively low (mostly below 10 per cent), there remain key sectors with relatively high maximum tariffs. Animal products such as live poultry, meat of swine, plant products, cabbages and coffee, and other food products like prepared or preserved meats, meat offals or blood are among the products that are still imposed tariffs of about 32.86 per cent. As seen from Table 3, the AIFTA has a relatively better utilization rate than other Philippine FTAs such as ASEAN-Japan or ASEAN-Korea. The figures signify that about 40 per cent of imports from India are still being subject to higher tariffs, despite the presence of lower options.

Table 2: HS groups with highest tariff for the Philippines under ASEAN-India

Source: WITS, World Bank.

Table 3: Utilisation rates of Philippine trade agreements

Note: Others include AFMA and Board of Investments

Source: UNCTAD – Trade Analysis Information System (TRAINS), WTO

In November 2014, two other AIFTA agreements—Trade in Services Agreement and Investment Agreement were signed. The services agreement includes provisions on transparency, domestic regulations, market access, national treatment and dispute settlement. Meanwhile, the investment agreement stipulates fair and equitable treatment of investors, non-discriminatory treatment in expropriation or nationalization, and fair compensation.[3]

Under the AIFTA, members are also compelled to reduce non-tariff barriers in order to establish predictable, consistent and transparent trade practices.[4] Some of the initiatives include simplifying customs procedures, ensuring the transparency of permissible NTMs, and preventing countries from instituting NTMs that are not in accordance with the WTO. The Agreement also established a Joint Committee that is responsible for reviewing the implementation of AIFTA, as well as considering and recommending amendments.

The Philippines and India regularly hold Joint Working Groups (JWGs) to identify growth opportunities and potential areas for partnership. The Joint Working Group on Trade and Investment (JWGTI) reviews the status and assesses the progress of bilateral trade and investments cooperation, as well as economic, technical, scientific and technological activities.[5] Other JWGs include those for agriculture, health, tourism, renewable energy and counterterrorism.

Opportunities and Next Steps for Future Cooperation

In recent years, the Philippines and India have been seeking opportunities to expand their trade and investment relations. One potential step is the creation of a Philippines-India FTA, which was perceived to be an opportunity to further capitalise on each other’s complementarities. The bilateral FTA was acknowledged to be more manageable in addressing their respective sensitivities in tariff lines and presents an opportunity to expand the range of products traded between the two countries. Moreover, pursuing a bilateral FTA for stronger trade relations was deemed necessary considering India’s withdrawal from the Regional Comprehensive Economic Partnership.[6]

During a virtual courtesy call on 5 April 2022, the Indian Ambassador to the Philippines, Shambhu Kumaran, and Philippine Department of Trade and Industry Secretary, Ramon Lopez, noted that the Philippines could be India’s partner in the production of active pharmaceutical ingredients, vaccines, essential medicines and biologicals, including data centres and other related IT infrastructure. From India’s perspective, possible industries for cooperation include jeepney, electronic manufacturing and geothermal energy. These industries supplement those identified during the 13th Philippines-India JWGTI in September 2020, including agribusiness, electronics, infrastructure, renewable energy and manufacturing.[7]

For investments, the two countries have started negotiations on a bilateral investment treaty (BIT) in October 2020. The agreement has been in the pipeline for years after India proposed a new BIT based on the model text.[8] The following sectors have also exhibited significant progress in terms of facilitating trade and investments between the Philippines and India, and further cooperation in these sectors would be integral in strengthening the bilateral ties:

IT – non-voice sectors: medical, financial and legal services, game development, engineering design in manufacturing, software development

Collaboration in the BPO sector has grown exponentially in the last few years. With the exponential growth in collaborations last year, several Indian IT companies, including WIPRO, TCS, L&T Infotech, Innodata, IL&FS Genpact, Infosys, HIGS (Hindujas) and Tech Mahindra, have already set up BPO operations in the Philippines. This close partnership in IT and BPO has become mutually beneficial for both countries.[9]

Pharmaceuticals: generics, medical equipment, vaccine, over the counter, oncology and high-end medicines, herbal medicines

A recent study by GlobalData indicated that the Philippines’ pharmaceutical market is set to grow and reach around US$3.7 billion (S$5 billion) in 2025.[10] This is due to the introduction of the Universal Health Care Act in February 2019, coupled with corporate tax reforms applicable to domestic and foreign companies. The country is perceived to be an ideal manufacturing hub for Indian pharmaceutical companies because of the potential growth of the domestic market. Additionally, the Philippines could serve as an entry point to the rest of the ASEAN markets. The Philippines also hosts several natural ingredients such as moringa, yellow ginger and virgin coconut oil that are commonly used in pharmaceutical products.[11]

Furthermore, Indian pharmaceutical companies have established a strong presence in the Philippine pharmaceutical (generics) industry. Major Indian firms like Dabur Pharma, Torrent, ZydusCadilla , Claris Life Sciences and Lupin, which has also acquired a stake in a local company, have set up liaison offices to promote their products.

Infrastructure

Building on the rapidly expanding infrastructure demands of the Philippines, initiatives have been rolled out to attract Indian investments. In February 2021, the Embassy of India in Manila, in cooperation with the Confederation of Industry and Philippine Chamber of Commerce and Industry, organised the Business Conference on India-Philippines Infrastructure Cooperation. Several Indian firms are considering entering the Philippines’ infrastructure market, valued at US$343 billion (S$468 billion) until 2025.[12]

Aside from physical infrastructures, the Philippines could potentially cooperate with India on improving digital infrastructure and supporting its banking and finance sectors. In a virtual meeting in March 2021, Ambassador Kumaran mentioned to Philippine Secretary of Finance Carlos Dominguez that India could lend its expertise to the Philippines in setting up its national broadband network and national identification system. India could also assist in rolling out a shared cyber-defence plan for state-run banks and their subsidiaries in the Philippines.[13]

Manufacturing: electronics, shipbuilding, tools and dyes, furniture, garments, power and transport, automotive

Renowned groups like Tata Motors and Mahindra have also made their presence felt in the automobile sector. Along with its partner Pilipinas Taj Autogroup Inc., Tata Motors distributed commercial vehicles in the Philippines, including the newly revealed Prima Heavy truck platform, an entire range of heavy intermediate and light commercial vehicles, mini trucks, pickups and buses.[14] As the Philippine partners of Tata Motors are focusing mainly on sales, an area for further cooperation would be for Tata Motors to explore the feasibility of transferring automotive manufacturing segments to the Philippines.

Meanwhile, Mahindra Motors is already an active player in the Jeepney Modernization Program of the Philippine Department of Transportation through the supply of modern jeeps, a common mode of transportation for Filipinos.[15]

Renewable energy

The Philippines and India are keen on cooperating in renewable energy as both countries have set targets on different renewable energy sources.[16] To pursue this cooperation, the Philippines and India have drafted an MoU on energy cooperation which is expected to provide the platform for discussing policies and programs on harnessing renewable sources between the two countries. As of July 2021, the document is still under review by the Philippine Department of Foreign Affairs.

Agribusiness

India has committed to support the Philippines in intensifying technological transfer in the country’s agriculture and fishery industries. A bilateral collaboration between the two countries in agricultural and financial technologies (agritech and fintech) has been proposed, aiming to improve the operations of small farmers and address constraints in the country’s agriculture value chains and access to finance. According to Ambassador Kumaran, the Indian government has commenced talks with Finance Secretary Dominguez regarding a potential agritech and fintech exchange. One of the agreement’s provisions is providing the Development Bank of the Philippines with a technology that would allow it to calculate risks in the provision of credit to farmers using geospatial and satellite data.[17] Other initiatives proposed include skills training partnership, a dialogue on garlic market access, an exchange of integrated farming strategies, partnerships in solar energy and organic food production.[18]

Tourism

In 2019, the Philippine Department of Tourism and the Indian Ministry of Tourism signed an MOU to expand bilateral cooperation in the tourism, trade and hospitality sectors.[19] Among others, the five-year MoU entails initiatives on mutual visits, the exchange of promotion, marketing, destination, development and management experiences, exchange of official standards and certification practices, and the development of tour packages.

The new and modernised air services agreement between the Philippines and India could also boost tourism and strengthen cultural ties. Inked in September 2021, the agreement is an update of the 1949 air services agreement, and it aims to promote international air services, advance a high-quality international aviation system and ensure air safety between the two countries.[20]

Logistics

The Philippines and India signed the MoU on Defense Industry and Logistics Cooperation during the visit of Indian Prime Minister Narendra Modi to the Philippines in November 2017. The MoU includes a framework for enhancing cooperation in logistics support and services, as well as in the development, production and procurement of defense materials.[21]

Aside from the bilateral air services agreement, the MoU on the Sharing of White Shipping Information could be useful in determining the next steps to improve logistics cooperation. The MoU, signed in October 2019, entails sharing information on non-military and non-government shipping vessels between the Philippines and India.[22] While the deal focuses primarily on enhancing maritime security, it could provide vital information on possible logistical bottlenecks, which could serve as a basis for policy formulation.

Conclusion

Despite the modest trade and investment relations between the Philippines and India, India’s relationship with ASEAN as a whole was viewed through improvements in trade and FDI figures. However, with policies such as the AIFTA potentially stimulating these improvements, it is crucial to sustain the momentum and strengthen the relationship between the Philippines and India. Indeed, there is room for more cooperation and collaboration between the Philippines and India, as indicated by the findings in this paper.

Although both nations have shown strong ties over the last decade, it would be valuable for the Philippines to actively continue its engagement with India. Moreover, the country should assess how its prospective agreements (including those with other economies) could potentially affect its engagements with India. The relatively high utilisation rate of the AIFTA could be encouraging for the Philippines to actively promote the agreement among firms and address key impediments to firm utilisation. In this regard, an important initiative would be the continuous liberalisation of the ASEAN-India tariff structure, especially in agriculture and food products.

While the Philippines has not been a major investment destination for India, the notable projects that Indian companies recently conducted are still positive signs for expanding cooperation. As the two countries look for more collaboration opportunities, the eight identified sectors have the greatest potential to snowball investment. These sectors could serve as catalysts for greater trade and investment facilitation. It would also be highly beneficial to evaluate the impacts of the discussed initiatives on the sector involved and other industries in the Philippines.

. . . . .

Dr Francis Mark A Quimba is a Senior Research Fellow at the Philippine Institute for Development Studies and Director of Philippine APEC Study Center Network. Mr Neil Irwin S Moreno is a Supervising Research Specialist at the Philippine Institute for Development Studies. They can be reached at Dr Quimba’s email address at fquimba@pids.gov.ph. The authors bear full responsibility for the facts cited and opinions expressed in this paper.

[1] Alexander Chipman Koty, “The ASEAN-India Trade in Goods Agreement”, ASEAN Briefing, 18 October 2021, https://www.aseanbriefing.com/news/asean-india-trade-in-goods-agreement/.

[2] “ASEAN-India Free Trade Area: A primer”, Philippine Tariff Commission, 2018.

[3] “ASEAN-India Free Trade Area (AIFTA): Building strong economic partnerships”, Association of Southeast Asian Nations, https://www.asean.org/wp-content/uploads/images/2015/October/outreach-document/Edited%20AIFTA.pdf.

[4] Alexander Chipman Koty, “The ASEAN-India Trade in Goods Agreement”, ASEAN Briefing, 18 October 2021, https://www.aseanbriefing.com/news/asean-india-trade-in-goods-agreement/.

[5] “Philippine-India Relations: An overview”, Embassy of the Philippines, New Delhi, India, https://newdelhipe.dfa.gov.ph/index.php/86-philippines-india-relations/93-philippine-india-relations-an-overview.

[6] Elijah Felice Rosales, “PHL, India eye bilateral preferential trade accord”, Business Mirror, 30 September 2020, https://businessmirror.com.ph/2020/09/30/phl-india-eye-bilateral-preferential-trade-accord/.

[7] “PH, India to tap new trade and investment opportunities”, Department of Trade and Industry, 6 April 2021, https://www.dti.gov.ph/archives/ph-india-new-trade-investment-opportunities/.

[8] “Bilateral trade and economic relations”, Embassy of India, Manila, 30 April 2020, https://www.eoimanila.gov.in/eoi.php?id=bilateral-trade-and-economic-relations/.

“India and Philippines commence negotiations on investment treaty”, The Economic Times, 25 October 2020, https://economictimes.indiatimes.com/news/economy/policy/india-and-philippines-commence-negotiations-on-investment-treaty/articleshow/78861677.cms?from=mdr.

[9] “Bilateral trade and economic relations”, Embassy of India, Manila, 30 April 2020 https://www.eoimanila.gov.in/eoi.php?id=bilateral-trade-and-economic-relations/.

[10] Hannah Balfour, “New opportunities for Indian pharma industry in Philippines, finds study”, European Pharmaceutical Review, 5 December 2019, https://www.europeanpharmaceuticalreview.com/ news/107476/new-opportunities-for-indian-pharma-industry-in-philippines-finds-study/.

[11] “PH can be India’s pharma manufacturing hub for ASEAN – DTI-EMB”, Department of Trade and Industry, 7 August 2020, https://www.dti.gov.ph/negosyo/exports/emb-news/ph-can-be-indias-pharma-manufacturing-hub-for-asean-dti-emb/.

[12] “Business Conference on India-Philippines Infrastructure Cooperation”, BusinessWorld Online, 22 February 2021, https://www.bworldonline.com/business-conference-on-india-philippines-infrastructure-cooperation/.

[13] “PHL, India to enhance economic partnership in infra development, digital technologies”, Department of Finance, 3 January 2021, https://www.dof.gov.ph/phl-india-to-enhance-economic-partnership-in-infra-development-digital-technologies/.

[14] Alvin Uy, “Tata Motors strengthens Philippines’ presence”, Motioncars, 29 July 2017, https://motioncars.inquirer.net/50831/tata-motors-strengthens-philippines-presence#ixzz7KOVXr1Qr.

[15] “Bilateral trade and economic relations”, Embassy of India, Manila, 30 April 2020, https://www.eoimanila.gov.in/eoi.php?id=bilateral-trade-and-economic-relations/.

[16] Jordeene Lagare, “India, PH to bolster energy cooperation”, The Manila Times, 30 July 2021, https://www.manilatimes.net/2021/07/30/news/national/india-ph-to-bolster-energy-cooperation/1808998.

[17] Revin Mikhael Ochave, “India proposes collaboration to upgrade small-farm operations”, BusinessWorld Online, 30 March 2021, https://www.bworldonline.com/india-proposes-collaboration-to-upgrade-small-farm-operations/.

[18] Revin Mikhael Ochave, “India proposes collaboration to upgrade small-farm operations”, BusinessWorld Online, 30 March 2021, https://www.bworldonline.com/india-proposes-collaboration-to-upgrade-small-farm-operations/.

[18] Ibid.

[19] Joyce Ann Rocamora, “PH, India ink pact to expand ties on tourism, hospitality sector”, Philippine News Agency, 23 October 2019, https://www.pna.gov.ph/articles/1083954.

[20] Richmond Mercurio, “Philippines, India ink air services agreement”, Philstar.com, 29 September 2021, https://www.philstar.com/business/2021/09/29/2130353/philippines-india-ink-air-services-agreement.

[21] Rahul Mishra, “India and the Philippines: Time to go beyond the ASEAN Framework”, S. Rajaratnam School of International Studies, 2019, https://www.think-asia.org/bitstream/handle/11540/10861/PR190801_ India-and-Philippines.pdf?sequence=1.

[22] Pia Ranada, “PH, India sign maritime security deal during Kovind visit”, Rappler, 18 October 2019, https://www.rappler.com/nation/242883-philippines-india-sign-maritime-security-deal-kovind-visit/.

Photo Credit/Source: Prime Minister’s Office India

-

More From :

More From :

-

Tags :

Tags :

-

Download PDF

Download PDF