India’s Public Investment-led Approach to Economic Growth: Reflections on Outcomes and Future Prospects

Amitendu Palit, Divya Murali

19 November 2024Summary

Since the outbreak of the COVID-19 pandemic, India has been prioritising a public investment-led approach to sustaining demand and high economic growth. The approach did produce expected outcomes in the years right after the pandemic, as is evident from the strong recovery of the Indian economy. Subsequently, however, budgeted capital outlays have been showing underutilisation with actual capital expenditure falling short of budgeted amounts. This has raised attention on whether the economy is able to create enough absorptive capacity for high public investments, by attracting enough private investments, both domestic and foreign. This insight paper explores the trends in India’s economic recovery through public and private investments since the beginning of the current decade and argues that more effective utilisation of public funds requires private investments to be drawn in through effective public-private partnerships. Successful examples of the latter must be demonstrated for further growth of such collaborations.

Background

Since the beginning of the current decade, India’s macro-economic strategy has emphasised on sustained increase in government capital expenditure (capex) through investments in infrastructure projects. This follows from the notion that government capex will be the main driver of economic investments, which, in turn, will raise aggregate demand and overall economic growth.

The Union Budget for the fiscal year (FY) 2021-22, and the subsequent Budget for FY2022-23, laid the framework for higher public investments in modern infrastructure. India’s Finance Minister Nirmala Sitharaman articulated the importance of greater capex in her budget speech for FY2022-23 by indicating that higher public investment is necessary for drawing in more private investment.[1] The raison d’être for greater public investment is supported by economic literature that demonstrates increasing capex improves the quality of overall spending and has a significantly better multiplier effect in reviving the economy, as opposed to an approach that promotes revenue transfer.[2]

The latest Union Budget presented on 23 July 2024 – the first Budget of Modi 3.0 – marks five years of a macroeconomic strategy with continued emphasis on increasing government capex. This paper examines the macro character of the capex-led approach to economic growth and its implications.

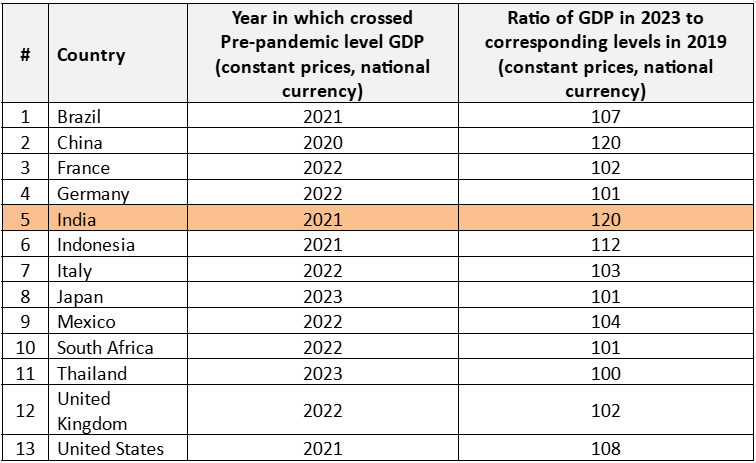

Growth and Capital Expenditure in India since FY2020-21

The Indian economy was in a macroeconomically comfortable position in the run-up to the Budget with government estimates predicting a real Gross Domestic Product (GDP) growth rate of 8.2 per cent for FY2024-25.[3] According to the Economic Survey of the Ministry of Finance for 2023-2024, India had one of the strongest recoveries – among the world’s major economies – since the COVID-19 pandemic in 2020. Not only did the GDP growth return to the pre-pandemic level in 2021 itself but by 2023, the Indian economy recorded the largest increase in GDP growth from the pre-pandemic level of 2019, thereby making it, along with China, the two among the world’s major economies that recovered most quickly (Table 1). The Indian turnaround, ostensibly, was largely on account of the demand-push imparted by government capex.

Table 1: Growth Recovery Since the Pandemic – Global Snapshot

Source: Economic Survey 2023-2024, Chapter 1 “State of the Economy”, Chart I.3, Page 4; https://www.indiabudget.gov.in/economicsurvey/doc/eschapter/echap01.pdf.

The strong emphasis on the adoption of a public investment-led growth strategy has resulted in the central government budgeted outlay for capex on capital accounts growing between 33 per cent and 35 per cent year-on-year during the period FY2020-21 to FY2023-24 (Chart 1). The substantial increase in budgetary outlays marks an unprecedented increase in the government’s allocation of funds for capex.[4]

Chart 1: Year-on-Year Growth on Capital Account of Effective Capital Expenditure (Budgeted)

Source: Appendix Table 1. Computations by authors.

The high capex-led growth approach adopted after the pandemic was to boost investor confidence and help ‘crowd-in’ private investments leading to the revival of GDP growth. This is exactly what happened immediately after the pandemic. Indeed, with actual spending exceeding the budgeted outlays for FY2020-21 and FY2021-22 (Appendix Table 1), there is no doubt that the economy displayed a strong appetite for absorbing the investment-led push on growth. This further indicates that growth was fuelled by those sectors that could recover faster from the setbacks suffered during the pandemic through greater absorption of public capex, such as domestic connectivity projects, public housing, transport and healthcare. The Economic Survey finding reported in Table 1 which shows that India crossed its pre-pandemic GDP level in 2021 supports this conclusion.

Moving forward, however, the trajectory appears to have shifted. With the economy recovering from the pandemic lows and settling into a new normal, its absorptive capacity seems to have slowed down. This is indicated by actual capex being lower than budgeted capital outlays in FY2022-23 and FY2023-24 (Appendix Table 1), in sharp contrast to the previous two years. Indeed, the gap between budgeted total effective capex and actual spending increased in these years underlining lesser utilisation of budgeted funds, which, presumably, is due to the growing inability of the economy to absorb more public spending.

In the current FY (2024-25), the budgeted outlay for government capital spending shows an increase of 11 per cent over FY2023-24. The increase is much less than the annual increases seen in the earlier years, right after the pandemic (Chart 1). The smaller annual increase might be a result of the growing level of unspent budgeted outlays in the previous two years. If the underspending increases in the coming years, then it is necessary to take a closer look at the effectiveness of the public investment-led growth strategy.

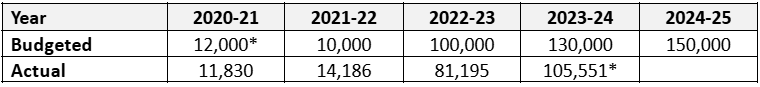

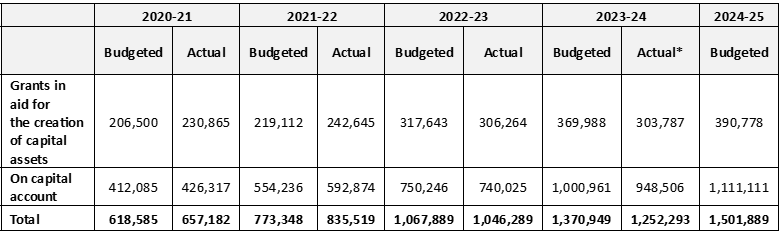

The issue of lower absorptive capacity and underspending is not limited to the central government alone. A similar tendency is visible for states if one looks at the role of states in supporting the central government’s investment-led approach to growth. This can be discerned from the data on the special assistance scheme announced by the centre in the Union Budget for FY2020-21, which provides 50 years of interest-free loans to the states for implementing the centre’s capex initiatives. Table 2 provides the actual and budgeted data for the scheme. Barring FY2021-22, the special assistance extended to states as interest-free loans for implementing the centre’s investment initiatives has consistently been underused (Table 2).

Table 2: Special Assistance as Loan to States for Capital Expenditure (INR Crore)

Source: Compiled by Authors from India Budget Documents; * Revised estimate

Both the central and state fund utilisation trends underscore less utilisation pointing to reducing capacities for absorption of more capex.

Did the Government Investment crowd-in Private Investment?

The issue of lower absorptive capacity draws attention to the possibility of high government capex not having been able to generate adequate private investment. More private investments would have created supportive activities that would have increased the demand for more government funds. For example, an increase in government investment in domestic infrastructure projects, such as highways and expressways, should have ideally created more tourism and recreational facilities around the new infrastructure. Those facilities, in turn, could have generated more demand for supportive urban facilities leading to greater absorption of public investments. The question that arises in the face of lower absorptive capacity, is whether the high capex succeeded in drawing in private investment.

Private investment can be both domestic and foreign investment. The trend of domestic private investment can be discerned from statistics on gross capital formation. Similarly, the trend of foreign investment can be identified from annual data on foreign direct investments (FDI) and foreign portfolio investments. Whether lower absorptive capacity for public funds in the economy is arising from insufficient private investments is a question that requires a review of the trends of both categories of private investments.

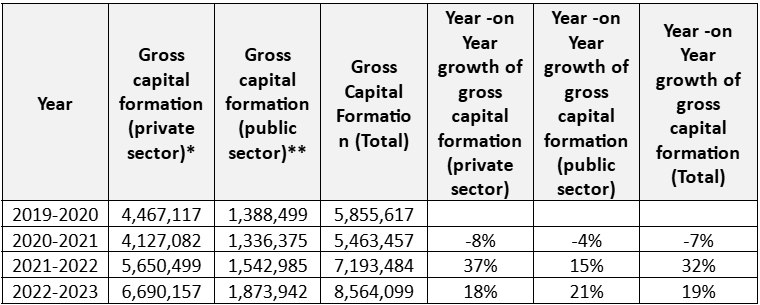

Domestic Private Investment

The gross capital formation statistics are available only up to FY2022-23 (Table 3). According to these statistics, private domestic capital formation increased by 37 per cent in FY2021-22. This sharp increase could have been due to policies for kickstarting private investments such as the Production Linked Incentive schemes. In the next year, however, the rate of increase came down to 18 per cent. Public capital formation, on the other hand, showed an increasing trend by growing from 15 per cent in FY2021-22 to 21 per cent in FY2022-23.

Table 3: Gross Capital Formation (in INR Crores)

Source: Economic Survey 2023-2024, Statistical Appendix, Table 1.8; *Private sector includes private non-financial corporations, private financial corporations and households, including NPISH (non-profit institutions serving households); and **Public sector includes public non-financial corporations, public financial corporations and the government.

While more data is required to support the conjecture of private investment not matching up with high levels of public investment, the mismatch, at least in terms of domestic private investment in the immediate years after the pandemic, is evident.

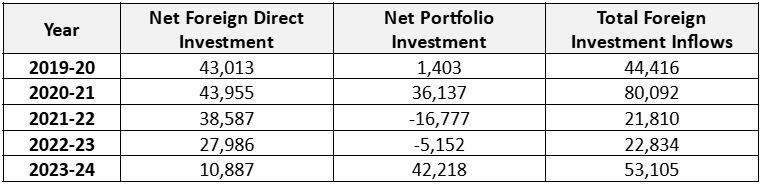

Foreign Investments

Table 4 shows the trends of foreign investment inflows to India during the period FY2019-20 to FY2023-24. Total foreign investment inflows (net) are aggregations of net long-term FDI and net short-term portfolio investments. The Reserve Bank of India’s statistics of foreign direct and portfolio investments in this regard reveal some interesting insights.

Table 4: Foreign Investment Inflows to India (US$ millions)

Source: RBI database on Indian Economy

Between FY2019-20 and FY2023-24, total foreign investment inflows have shown a somewhat erratic trend. There was an almost doubling of these inflows in FY2020-21 due to a sharper increase in portfolio investment inflows. However, the next year showed an outflow of these investments, along with a lower volume of direct investments, leading to a much lower level of overall foreign investments. Thereafter, net FDIs have shown a perceptible reduction in their annual inflows. At the same time, portfolio investments have also been volatile leading to successive years of outflows and then a strong turnaround in FY2023-24.

Among both categories of investments, the ability to enlarge domestic absorptive capacity is more with FDIs. These are those that are longer-term and capable of creating new capital assets in the economy along with more employment. However, with net FDI showing a progressively lower rate of inflow each year, there is clearly much less capacity that is being created through foreign private investments.

Conclusion

The government of India adopted an investment-led approach to recovery of economic growth since the onset of the COVID-19 pandemic. The emphasis resulted in the devolution of large budgetary outlays on government capex. After the initial years of the decade though, the multiplier effects of high capex seem to be bottoming out with actual capex falling short of budgeted amounts. The reason, arguably, is a lack of increase in the domestic absorptive capacity of the economy, which again, is due to insufficient increase in private investments, both domestic and foreign.

The economic rationale behind the emphasis on public investment-led growth is definitely acceptable, as it is investments that create demand and set in motion a virtual cycle of more investments and consumption in driving the economy. While the approach should be persisted with, perhaps it is important to moderate expectations in line with India’s existing capacities for utilising higher capex. The way forward in ensuring that benefits from higher capex are maximised is to ensure that more private investments are committed to the economy, which, could be mobilised through effective public-private partnerships (PPPs), or by building conducive eco-systems imbibing enabling infrastructure for private investments. Successful PPPs in various sectors, including manufacturing and services, will act as ‘pulls’ for more investments. Good examples of PPPs from semiconductors, future resilient cities, ‘green’ industrial parks and logistics, can be of great value in this regard.

. . . . .

Dr Amitendu Palit is a Senior Research Fellow and Research Lead (Trade and Economics) at the Institute of South Asian Studies (ISAS), an autonomous research institute at the National University of Singapore (NUS). He can be contacted at isasap@nus.edu.sg. Ms Divya Murali is a Research Associate at the same institute. She can be contacted at divya.m@nus.edu.sg. The authors bear full responsibility for the facts cited and opinions expressed in this paper.

Appendix

Table A1: Effective Capital Expenditure (in INR crores)

Source: Compiled from India Budget Documents; *Provisional Actuals

[1] Budget 2022-2023, Speech of Nirmala Sitharaman, Minister of Finance, Government of India, 1 February 2022, https://www.indiabudget.gov.in/doc/bspeech/bs202223.pdf.

[2] Bose, Sukanya, and N R Bhanumurthy, 2013. Fiscal Multipliers for India, Working Paper No. 125, NIPFP, New Delhi; ‘Took capex route for multiplier effect: Nirmala Sitharaman’, The New Indian Express, 12 February 2022, https://www.newindianexpress.com/business/2022/feb/12/took-capex-route-for-multiplier-effect-nirmala-sitharaman-2418508.html.

[3] Press Note on Provisional Estimates of Annual GDP for 2023-2024 and Quarterly Estimates of GDP for Q4 of 2023-24, The National Statistical Office (NSO), Ministry of Statistics and Programme Implementation (MoSPI), Government of India, https://www.mospi.gov.in/sites/default/files/press_release/PressNoteGDP31052024.pdf.

[4] ‘Union Budget 2023 recap: Modi government’s record capex push & its impact on Indian economy’, The Economic Times, 1 February 2024, https://economictimes.indiatimes.com/news/economy/policy/budget-2023-recap-modi-governments-record-capex-push-its-impact-on-indian-economy/articleshow/106611282.cms?from=mdr.

Pic Credit: Twitter

-

More From :

More From :

-

Tags :

Tags :

-

Download PDF

Download PDF