Summary

This being an election year for India, the government presented only a vote on account in early February 2024. This will permit it to incur routine expenditures over the next four months. The vote on account has been conservative on its tax buoyancy, it attempts very ambitious fiscal deficit targets, abjures populist freebies and continues its increased spending on the development of infrastructure. The government has taken a long-term view and decided to abjure short-term measures.

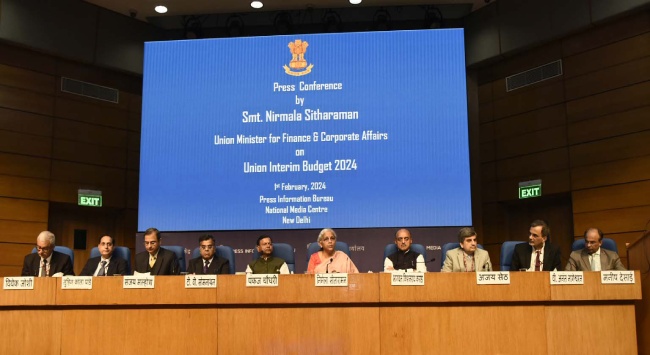

As is the tradition in an election year, Indian Finance Minister Nirmala Sitharaman presented a vote on account, in lieu of a regular budget, on 1 February 2024. The vote on account is merely to give an account of receipt and expenditure and get parliamentary approval to incur expenditure on salaries and other such committed items over four months till an elected government can present a full budget.

Usually, votes on account by Indian governments in an election year do not contain any new policy announcements or tax proposals. These are also traditionally passed without any debate. Governments have, nevertheless, been known to make populist announcements or at least give broad indications of attractive allurements that they would provide when elected. However, the National Democratic Alliance (NDA) government eschewed such populist announcements in the budget of February 2023, which was its last full budget for the present tenure. In the current year also, no freebies have been indicated which points to its confidence level in retaining power post elections. The budget has three major features of ‘intent’.

Firstly, it points to the fact that the government does not believe in a culture of ‘freebies’ or populist ‘giveaways’ which would attract voters. These ‘freebies’ are a drain on the treasury and serve as a false ‘crutch’ to the poorer strata. In the long run, this is damaging as it perpetuates a culture of eking out a marginal existence on free rations, unemployment doles and free transportation without putting in that extra effort to uplift the family’s well-being.

Secondly, the government, after its resounding performance in the state elections of Chhattisgarh, Madhya Pradesh and Rajasthan and the recent inroads made into the ruling front in Bihar, is confident of romping home in the general elections without providing avoidable allurements. This has given it a shot in the arm and afforded it the freedom to plan long-term.

The third significant feature of the budget has been the continuing provision of a substantial amount towards physical infrastructure creation and research and development (R&D) activities for the private sector. Investment from the private sector has not been forthcoming in the post-pandemic era and the government is attempting to kick start such investment which will generate employment, put disposal income in the hands of people and, thereby, generate rapid economic development.

Brimming with this confidence, the Indian finance minister has shown remarkable fiscal prudence and preferred consolidation over any other announcement which would have lured voters. The government proposes to ramp up infra spending to 3.4 per cent of gross domestic product (GDP) or ₹11.11 trillion (US$13.4 billion) in 2024-25. While the expenditure on roads and railways has been substantial, there seems to be a constraint on the absorptive capacity. A corpus of ₹1 trillion (US$1.2 billion) for 50-year interest-free or low-interest loans to facilitate deep technology R&D has been announced. This would provide a big boost for start-ups and companies working on breakthrough engineering and scientific advances. Start-ups, sovereign wealth funds and pension funds would be provided with tax incentives. This would also apply to units in international financial centres.

A surprising feature has been the announcement that the fiscal deficit would be reduced to 5.1 per cent of the GDP in 2024-25 and that it would be pared to 4.5 per cent of GDP in 2025-26. This is decidedly lower than the expectations of analysts. A persistently high fiscal deficit runs the risk of higher inflation. The government has been able to manage its fiscal deficit which had ballooned to 9.17 per cent of the GDP during the pandemic. In the post-pandemic period, the core inflation has been moderate at 3.8 per cent, though consumer inflation has been causing concern, largely due to food product prices remaining high.

Being conscious of the challenges of demographic growth, the government has proposed a high-powered committee to examine issues arising from demographic changes. Issues linked to jobs, skilling, urbanisation and segments that need attention for faster development may constitute the remit of the committee.

Among other features, electrical vehicle manufacturing and charging eco-system is poised to get a major boost so that possessing and running such vehicles becomes attractive. The government has been consistently emphasising the shift to renewable power and solar energy. It proposes to set up 10 million rooftop solar power units for households. This would ensure free power of up to 300 units every month to households.

Despite the souring of the relationship with the new Maldivian government, a grant of ₹600 crores (S$97 million) has been set apart to develop projects for port connectivity and infrastructure. Work on the US$500 million (S$673.1 million) Greater Malé Connectivity Project is proposed to continue as originally planned. The recent differences with the government in office in Malé do not appear to have caused any hiccup in this allotment.

The Indian finance minister conceded that there is a significant disturbance in the Red Sea and Middle East region and indicated the government’s commitment to the “strategic and economic game changer viz the India-Middle East-Europe Economic corridor project. Another indication of the government attempting to be more realistic and less ambitious is the target for disinvestment of the public sector units. These invariably were ambitious targets and remained unrealised. In fact, in the current year’s budget, the target was pared down from ₹51,000 crore (S$8.2 billion) to ₹30,000 crore (S$4.8 billion). It has however, realised only ₹12,504 crore (S$2.2 billion). Probably taking a cue from the practical difficulty in achieving the targets as undertakings such as IDBI Bank, logistics firm Concor, BEML Limited (formerly Bharat Earth Movers) and Shipping Corporation of India could not be divested as yet, a modest target of ₹50,000 crore (S$6.25 billion) has been fixed.

Overall, the vote on account has followed textbook prescriptions and focused on long-term objectives rather than short-term electoral gains. The full budget to be presented in July 2024 would reveal the policy purports of the government over its next tenure.

. . . . .

Mr Vinod Rai is a Distinguished Visiting Research Fellow at the Institute of South Asian Studies (ISAS), an autonomous research institute in the National University of Singapore (NUS). He is a former Comptroller and Auditor General of India. He can be contacted at isasvr@nus.edu.sg. The author bears full responsibility for the facts cited and opinions expressed in this paper.

Pic Credit: PIB

-

More From :

More From :

-

Tags :

Tags :

-

Download PDF

Download PDF